Importation of Alcoholic Beverages and Cigarettes

The alcoholic beverages and cigarettes exempted from duty are listed as follows:

-

No more than 200 cigarettes or 250g of tobacco or 250g of all types combined

-

No more than 1 litre of alcoholic beverage

The excess quantities of cigarettes, tobacco or alcoholic beverages must be dropped in the box provided by Customs, otherwise prosecution will be carried out.

Customs Procedure for arriving passengers at the Nothing to Declare or Green Channel

Passengers with nothing to declare means they do not have any items liable for duty and taxes and prohibited or restricted goods with them when arriving in Thailand. For this case, they should use the Nothing to Declare lane, and the following items are exempted from duty:

-

Personal belongings in reasonable quantity, which are worth no more than 20,000 baht in total and are not prohibited or restricted goods or food

-

No more than 200 cigarettes or 250g of tobacco or 250g of all types combined

-

No more than 1 litre of alcoholic beverage

-

For the excess quantities of cigarettes, tobacco or alcoholic beverages, they must be dropped in the box provided by Customs, otherwise prosecution will be carried out.

As the Customs Department aims to facilitate passengers to the extent possible, we have adopted Risk Management techniques to screen passengers' baggage. Below are information about screening and inspecting passengers' baggage at the Goods to Declare or Red channel.

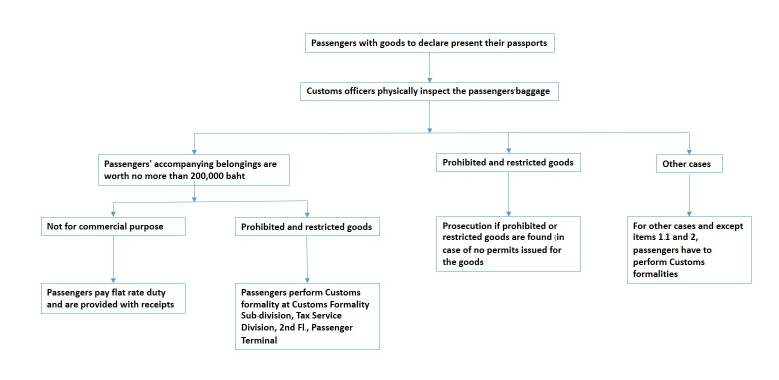

Customs Procedure for arriving passengers at the Goods to Declare or Red Channel

Documents required to be presented

-

Passport

-

Invoice or receipt (if any)

Customs Procedure

-

Passengers with goods to declare present their passports along with invoices or receipts (if any)

-

Customs officers at the "Goods to Declare" channel examine the passengers' passports and physically inspect their baggage. The Customs procedure involved can be divided into the following:

-

Case 1 Passengers' accompanying belongings which are not for commercial purpose and do not exceed 200,000 baht in value

Procedure

1. Customs officers at the "Goods to Declare" channel assess flat rate duty and taxes

2. Passengers make payment of duty and taxes by cash or debit/credit card

3. Passengers are provided with payment receipts and retrieve their belongings

-

Case 2 Prohibited or restricted goods

Procedure Prosecutions are carried out to the passengers

-

Case 3 Other cases than 1 and 2

Procedure

1. Passengers prepare and submit Import Declaration at Customs Formality Sub-division, Tax Service Division, 2nd Fl., Passenger Terminal, Suvarnabhumi International Airport

2. Passengers make payment of duty and taxes by cash or debit/credit card

3. Passengers are provided with payment receipts and retrieve their belongings

Procedure of Screening and Inspecting Arriving Passengers Baggage

Source: https://shorturl.asia/VaIgZ

Customs Care Center : The Customs Department, 1, Suntorn Kosa Road, Klong Toey, Bangkok, 10110

Fax : +66-2667-7767

E-mail : saraban@customs.go.th

Call Center: 1164